Reading Time: 12 Minutes

GRIN also recommends this free guide:

How Much to Pay Influencers, Creators & Brand Ambassadors

Download GuideBeing a social media influencer can be a fun and lucrative endeavor—until you’re hit with an unexpected tax bill, that is. Understandably, influencer tax obligations can feel quite overwhelming, especially if you’re new to self-employment.

Simply put, if you generate a profit of $400 or more from sponsored content, affiliate links, endorsements, etc., then in the eyes of the IRS, you’re self-employed. This means you need to file a tax report even if your income stream is only part-time or irregular.

But what taxes apply to social media influencers? Are there any deductible business expenses? How can creators streamline the tax process to make it all a little less stressful?

Don’t let your influencers wait until tax season to find out. Share this blog with your creator roster to show them why being proactive about tax season is so crucial, and offer some tips for staying ahead of the game.

Unexpected tax bills can put you into a financial crisis—but that’s not the only reason you should proactively plan for tax season.

If you don’t file your tax reports—or if you file them incorrectly—you could end up in hot water with the IRS. Tax fraud, evasion, and failure to file all have severe penalties ranging from fines to jail time.

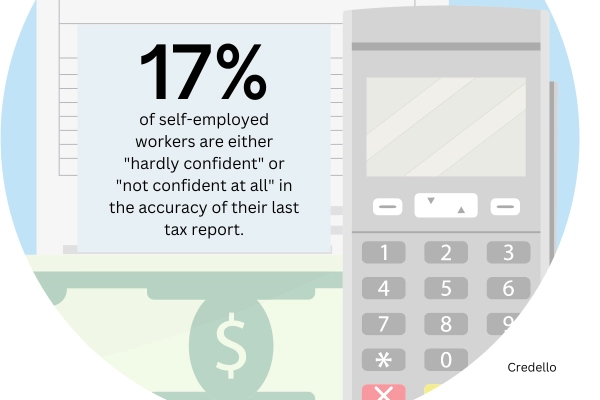

If you’re confused or worried about your influencer tax obligations, you’re not alone. 25% of self-employed workers are concerned about being audited due to an accidental error on their tax return. Seventeen percent are “hardly confident” or “not confident at all” regarding the accuracy of their last tax report.

Data via Credello

But, there are two key ways you can achieve proactive tax planning efficiency.

The first is to automate your invoicing process using billing software. Along with eliminating the risk of human error and ensuring your invoices are accurate, billing software stores all your data in a centralized location, ready for tax season.

So, no more scrambling around trying to find lost invoices or running into auditing problems because of a billing error.

Secondly, you need to brush up on your influencer tax obligations. This involves knowing what taxes you’re required to pay and why. A lot of people run into tax issues simply because they don’t realize they’re required to pay a specific tax.

To help you understand your tax obligations a little better, let’s now discuss the most important rules that apply—regardless of whether you classify yourself as a content creator or influencer.

These are the main tax obligations for social media influencers, YouTubers, bloggers, or any other type of online influencer.

Self-employment tax is paid by individuals who work for themselves. It consists of social security and Medicare taxes.

If you’ve ever been employed, you’ll know that social security and Medicare taxes are calculated and withheld by your employer. So, they’re pretty much out of sight, out of mind. But if you’re self-employed, you have to calculate and pay these yourself in the form of self-employment tax.

Currently, you’re obliged to pay self-employment tax if you generate a profit of $400 or more from self-employment in any given tax year.

Being self-employed, you’re solely responsible for reporting any income you make from your influencing activities. Failing to do so with 100% accuracy can land you in hot water should you get audited. Tracking your income and expenses throughout the year (instead of leaving it until the last minute) reduces the risk of errors and is much less stressful.

Paying estimated quarterly taxes instead of one lump sum in April is a good idea for the same reasons.

So, how do you go about reporting your income? There are two important forms you need to know: Schedule C and Form 1099.

Every bit of income you generate, from sponsored posts to affiliate marketing commissions, must be reported to the IRS. This is done via a Schedule C (Form 1040) tax form. Schedule C reports the volume of profit or loss you generated as a sole proprietor.

The next relevant form is Form 1099. You’ll receive one of these from every brand you work with that pays you $600 or more. These will also be sent to the IRS, but you need to keep your specific copy for auditing purposes.

Just note that even if you don’t receive a 1099 form (because you were paid less than $600), you still have to report this income to the IRS.

Accurately recognizing revenue and reporting your income is simple enough when you only work with one or two brands. But as your customer count increases and your contracts grow more sophisticated, things become more complex.

A good example of this is if you begin to create your own content on platforms like Patreon. This will require you to adopt a subscription revenue accounting model, which can complicate your revenue calculation and tax planning processes.

The more complex your revenue model becomes, the more important it is for you to automate your accounting and tax filing process to submit accurate tax reports.

Deductible expenses refer to any expenses incurred by your business that are—as defined by the IRS—“ordinary and necessary.” You can write off these expenses at the end of the tax year to reduce your tax bill.

This can result in some serious savings, but what expenses can you deduct? Here are a few examples:

Influencers must also pay state and local taxes (SALT), the sum of which differs depending on location and income source. Liberal states, for example, will typically enforce higher tax obligations than conservative states.

Paying SALT is important as it’s used to fund vital public services such as education, hospitals, road construction, law enforcement, etc.

SALT is deductible for any self-employed taxpayer who itemizes their deductions. Currently, the deduction is capped at $10,000 annually (or $5,000 if you’re filing separately as a married couple).

Taxes eligible for deduction include income tax, some service taxes, and property taxes.

One of the best things about being an influencer is that you have no geographical limitations—you can work wherever you like. Similarly, you can work with brands based all around the world.

But if you live outside your home country or work with an international brand, you may need to abide by international tax laws.

Tax deductible expenses and influencer freebies, for example, are treated differently around the world. Some countries impose high taxes on all freebies, while others decide how taxable freebies are based on their monetary value and whether they were given in return for a product review or promotion.

Sales tax is a consumption tax that the seller adds to the price of an item at the point of sale (POS).

If you, the seller, collect sales tax from the customer at POS, you then remit it to state and local governments. If you don’t collect sales tax at POS—because you’re operating in a state that doesn’t levy it—it becomes use tax instead. This means it’s the responsibility of the customer to remit the tax to the government.

So, how does this work for influencers? Well, every state has varying laws that differentiate taxable services and non-taxable services. Whether or not advertising is a taxable service in your state will determine whether you need to pay sales tax (or whether the brand you’re working with needs to pay use tax).

Perform a nexus study to get a better idea of how to navigate sales and use tax for your business.

As your business grows, you may need to hire employees or contractors to do the things you don’t have time for.

Hiring employees comes with pretty complicated tax obligations. You need to obtain an employer identification number (EIN), withhold federal income tax from your employee’s wages, pay unemployment tax, and more.

Enlisting the services of a freelancer or contractor doesn’t come with as many tax-heavy obligations, and you can deduct the cost of their services as expenses.

So, for example, you can deduct the costs of the freelance video editor you hired to professionally edit your YouTube videos or the web developer you used to build a promotional website.

Similarly, you can deduct the costs of legal, accounting, and bookkeeping services.

Don’t forget to use automated accounting software to streamline this process. The less time you spend filing taxes, the more time you can spend on growth-driving activities, such as trying out some of the latest Instagram reel trends.

Turning your online hobby into a fully-fledged business is an exciting journey, but when the dollars start to roll in, so do your tax responsibilities.

By ensuring you’re clued up on your influencer tax obligations, you can avoid any nasty surprises and stresses when tax season comes around. And, as a bonus, you can even enjoy tax savings by deducting business expenses—yes, even that fancy new ring light you’ve had your eye on. Just remember to keep your receipts.

Our team keeps a finger on the pulse, so you’re always working with the latest information.